Below table shows how

the Latest 5 Years ROE of APOLLO and LONBISC were achieved based on DuPont Analysis.

|

Year

|

2013

|

2012

|

2011

|

2010

|

2009

|

|

Net

Profit Margin

|

14.40%

|

10.84%

|

10.13%

|

15.47%

|

11.93%

|

|

Sales

Turnover

|

0.8692

|

0.8341

|

0.7541

|

0.7023

|

0.8328

|

|

Financial

Leverage

|

1.1133

|

1.1177

|

1.1213

|

1.1180

|

1.1141

|

|

ROE

|

13.94%

|

10.11%

|

8.56%

|

12.15%

|

11.07%

|

Table 1: ROE

for APOLLO

|

Year

|

2013

|

2012

|

2011

|

2010

|

2009

|

|

Net

Profit Margin

|

5.20%

|

5.43%

|

6.92%

|

8.09%

|

9.29%

|

|

Sales

Turnover

|

0.4244

|

0.4122

|

0.3857

|

0.4474

|

0.4116

|

|

Financial

Leverage

|

1.8815

|

1.8570

|

2.0790

|

2.0077

|

2.0269

|

|

ROE

|

4.15%

|

4.16%

|

5.55%

|

7.26%

|

7.75%

|

Table 2: ROE

for LONBISC

It is

clear from the table above that APOLLO has achieved a much higher ROE of 13.94%

compared to that of LONBISC of 4.15%. The higher ROE of APOLLO was achieved with

a relatively high income margin of 14.4% compare to LONBISC – 5.20% and higher

sales turnover (0.8692 vs 0.4244). Furthermore, APOLLO

was using a lower financial leverage of just 1. 11 compare to 1.88 of

LONBISC.

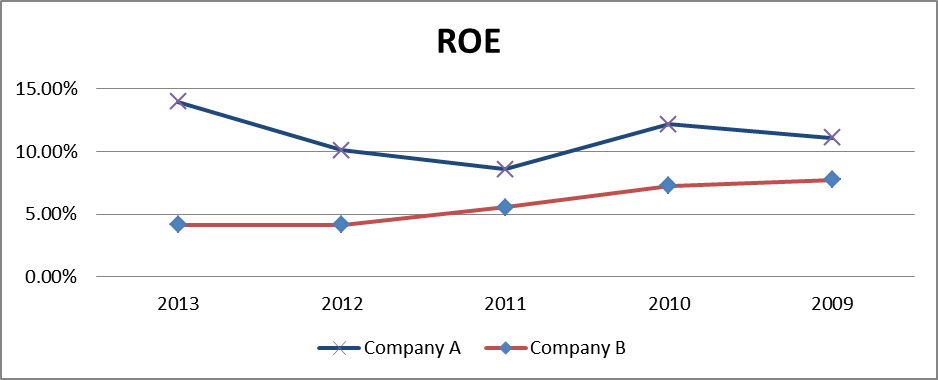

Figure 1:

Trends of ROE of APOLLO and LONBISC

Based on

the last 5 years results, the ROE for APOLLO is growing while LONBISC ROE is

shrinking. And, the growing of APOLLO’s ROE was achieved with growing Net Profit

Margin instead of other elements and this is the most desirable way to achieve a

higher ROE. While, LONBISC’s net profit margin is experiencing a negative growth

and this is the main contributor to the shrinkage of the

ROE.

|

A

|

B

| |

|

Short-term

loan

|

0

|

179,882

|

|

Long-term

loan

|

0

|

48,848

|

|

Hire

purchase creditors

|

0

|

10,823

|

|

Hire

purchase

|

0

|

23,523

|

|

Total

Debt

|

0

|

263,076

|

Table 3: Debt

for APOLLO vs LONBISC

|

A

|

B

| |

|

Cash

& Equivalents

|

64,863

|

27,210

|

|

Investment

- Securities

|

0

|

|

|

Current

Liabilities

|

134,436

|

241,617

|

|

Excess

Cash

|

0

|

0

|

Table 4:

Excess Cash for APOLLO vs LONBISC

Refer to

the Table 3, APOLLO is a debt free company and it can increase the financial

leverage and improves its ROE. However, financial leverage is a double edge

sword it can hurt ROE badly in the bad times. And, high leverage can make a

company’s balance sheet unhealthy and become risky during economy

downturn.

From the

above analysis, we can make a conclusion that APOLLO is much more efficient than

LONBISC as APOLLO have a higher ROE for the pass 5 year which achieved by higher

net profit margin, higher asset turnover and low financial leverage. Furthermore

APOLLO has an option to further increase the ROE by using financial

leverage.

References:-

No comments:

Post a Comment